tax lien search colorado

The following Tax Lien Sale Certificates may be purchased from Morgan County by paying the amount shown to the Morgan County Treasurer. Ad Buy Tax Delinquent Homes and Save Up to 50.

Tax Lien Truths The Mountain Jackpot News

The Colorado Department of Revenue CDOR is authorized to file a judgmentlien to collect your unpaid tax debt 39-21-114 3 CRS.

. Please check back for more information. 305 West Colorado Ave Telluride CO 81435. Can I terminate a federal tax lien.

About the Tax Lien Sale. Tax Sale - 2021 Delinquent Tax List. Parcel numbers beginning with 99000 or 99001 are for severed mineral interests.

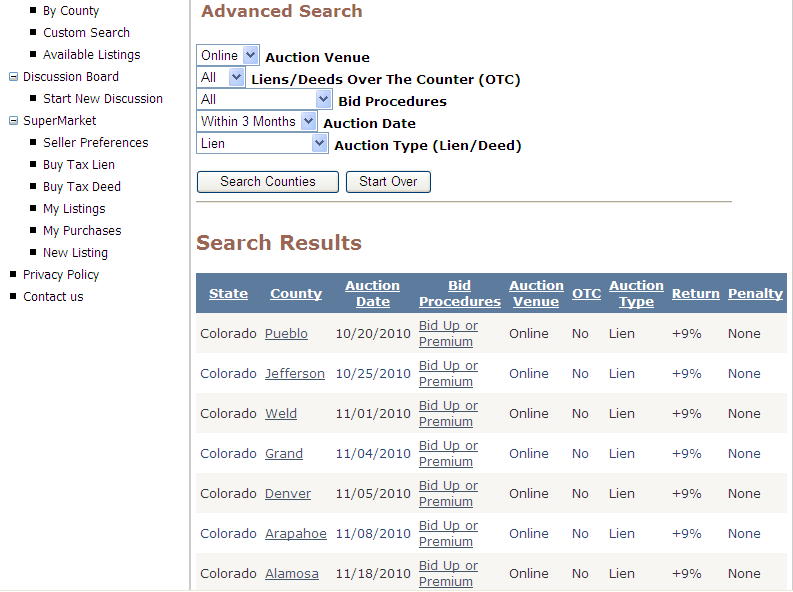

To search by document enter a document and select Search. Colorado uses the Premium Bid method. The highest bidder is awarded the tax lien to the property.

Exact amount due must be remitted no refunds will be issued. View Tax Sale Information for detailed instructions on how the online tax lien sale works. And state revenue agencies can place tax liens on parcels but the county treasurers office the county entity responsible for collecting property taxes can also place tax liens on parcels.

Looking for FREE property tax records assessments payments in Colorado. Many counties in Colorado especially the larger. HUD Homes USA Is the Fastest Growing Most Secure Provider of Foreclosure Listings.

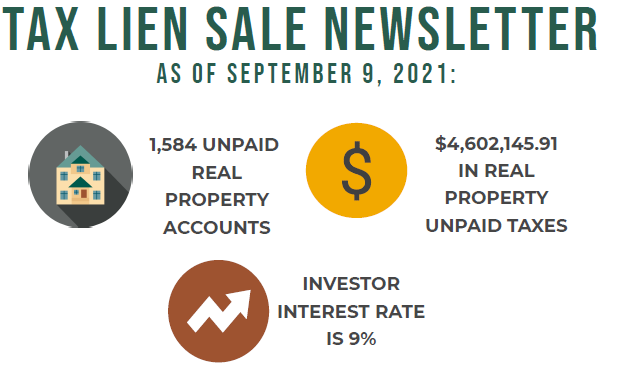

The lien remains effective until the IRS releases it. Only the IRS can terminate or release a federal tax lien. The 2022 Internet Tax Lien Sale will be held on Nov 3 2022 2022 Interest TBD after Sept 1 2022 2021 Interest Rate was 9.

San Miguel County Clerk and Recorder. Colorado tax lien auctions. For further information contact this office.

This will include records that lapsed within the past 2 years. Appointments for records requests are available at 1881 Pierce Street Lakewood. August 1 of each year tax sale buyers are offered the option of paying the current years unpaid.

The 2021 Tax Lien Sale will be held online on a date TBA. Public record property information and parcel maps are available on the Assessors Real Property Search Page. A tax lien is a claim against a property imposed by law to secure the payment of taxes.

PARC NE14SE14 B562 P126-7 LODI. Monday November 1 st 2021 1000 AM MT 1130 AM MT 1200 PM ET 130 PM ET. If it is a property lien the searcher needs the address to find out if the property has any liens attached to it.

The Tax Lien Sale is the final step in the effort to collect taxes on real property and mobile homes. Search San Miguel recorded documents including property records death records marriage records and tax liens by name document type or date range. This is a courtesy letter to allow the taxpayer one final chance to pay their tax debt.

The real estate tax lien public auction of unpaid taxes is held in November. Do not enter any additional search criteria. Payment of Subsequent Taxes.

The Alamosa County Treasurer holds a tax lien. In some cases the IRS will prepare a release or withdrawal form and give it to the taxpayer. Records that lapsed more than 2 years ago are no longer available.

List of County Held Tax Liens. Searching Up-To-Date Property Records By County Just Got Easier. Register for 1 to See All Listings Online.

Certificate of Taxes Due. If you have additional questions you may contact our office at 719 520-7900. Internet Tax Sale.

Colorado 856 Castello Avenue Fairplay CO 80440 Phone. The Grand County tax lien sale is held online at the Grand County Official Tax Certificate Auction Site. If the property owner does not pay the property taxes by late October the county sells the tax lien at the annual tax.

See Available Property Records Liens Owner Info More. Search Any Address 2. Ad Property Liens Info.

Liens in Colorado are public records. Colorado tax warrant and lien information by delinquent tax payer name and case number. Visit Delinquent Property Taxes page here for delinquent real property delinquent personal property delinquent mobile homes delinquent possessory interest and active tax liens.

Counties that use this method will have a starting bid that includes all delinquent taxes penalties and fees. A fee of 220 per searchhistory payable to the Colorado Department of Revenue must be submitted. Liens on personal property like cars bank accounts or assets are filed with the Colorado Secretary of State.

Colorado Secretary of State. Bidding starts at the set minimum and is bid up in price until the bidding stops. For any questions about Tax Lien Sales please contact our office at 303 795-4550.

Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Colorado Springs CO at tax lien auctions or online distressed asset sales. We advertise in the Colorado Community Media newspapers and the advertising list will also be. Tax Lien Sale Records.

A tax lien in Colorado is imposed by the state or local government on. The 2022 Internet Tax Lien Sale will be held on Nov 3 2022 2022 Interest TBD after Sept 1 2022 2021 Interest Rate was 9. Each tax lien is equal to the amount of the unpaid taxes interest penalty and fees the tax lien face value.

Treasurer Property Tax Search Assessor Property Search. If you received correspondence from our office notifying you that a Treasurers Deed has been applied for please contact our office 970 453-3440. A tax lien is a lien or a legal interest on a given tax parcel issued by a taxing entity.

The tax lien sale is the final step in the treasurers efforts to collect taxes on real property. Ad Find Colorado Tax Lien. Include lapsed records in the search results.

Clerk and Recorder of Deeds. CDOR will send a Notice of Intent to Issue JudgmentLien to the taxpayers last known address. Quickly search tax records from 549 official databases.

Supplemental Form for Existing Certificate Holders PDF Quick Links. County Held Tax Lien Sale Certificates. Investing in tax liens in Colorado is one of the least publicized but safest ways to make money in real estate.

The 2021 real estate tax sale will be held October 12 and 13 2021. The Tax Lien Sale Site is open for registration year-round. Any unpaid taxes will be advertised for sale in the local newspaper and will be sold if they are still not paid by the day before tax lien public auction.

Ad Ownerly Helps Homeowners Find Data On An Address Lien Owner Info More. A tax lien is placed on every county property owing taxes on January 1 each year and remains until the property taxes are paid. Phone 970728-3954 Fax 970728-4808.

Colorado Springs CO currently has 530 tax liens available as of January 15. The 2021 Tax Lien Sale will be Online. For certified records an additional 50 per title record or title history request must be submitted.

In accordance with 24-35-117 CRS the Colorado Department of Revenue is directed to annually disclose a list of delinquent taxpayers who have owed more than 20000 for longer than six months. In fact the rate of return on property tax liens investments in Colorado can be anywhere between 15 and 25 interest. As required by this statute each taxpayer meeting these criteria was notified by mail that failure to cure their tax.

Tax Lien Investing Pros And Cons Youtube

The Essential List Of Tax Lien Certificate States Tax Lien Certificates And Tax Deed Authority Ted Thomas

2020 Delinquent Tax Lien Sale Lake County Co

What To Do If You Receive A Irs Tax Lien Notice What Are Your Options Irs Fresh Start Program Helpline 1 877 788 2937 Tax Relief Blog May 3 2016

Irs Federal And State Tax Lien Help Genesis Tax Consultants

Understanding Tax Liens As A Self Directed Ira Investment

Definition Can A Tax Lien Be Removed Fortress Tax Relief

Tax Lien Information Larimer County

Irs Puts 1 4 Billion Liens On Brockman S Aspen Properties Aspentimes Com

The Free App We Use To Organize Our Tax Lien Deed Data Asana Youtube

How To Find Out About Tax Sales Tax Lien Investing Tips

Tax Lien Solutions Federal Tax Lien Relief Lifeback Tax

Tax Lien Investing Is A Game Even Hedge Funds Can Like The Denver Post

Colorado Tax Lien Auctions News With Stephen Swenson Of Tax Sale Support Learn About How Colorado Tax Lien Work And Investing Tutorial Investing Ebook Series